Article Licenses: unknown

Advisor Licenses:

Compliant content provided by Adviceon® Media for educational purposes only.

The following largely coincides with the guidance of the IRA’s information. The Information can change over time and your advisor and/or tax professional should be consulted.

The following largely coincides with the guidance of the IRA’s information. The Information can change over time and your advisor and/or tax professional should be consulted.

Retirement can last a long time

Why should you set up a retirement plan, and what are some of the benefits?

A retirement plan has lots of benefits for you, your business and your employees. Retirement plans allow you to invest now for financial security when you and your employees retire. As a bonus, you and your employees get significant tax advantages and other incentives.

Business Benefits

Employee Benefits

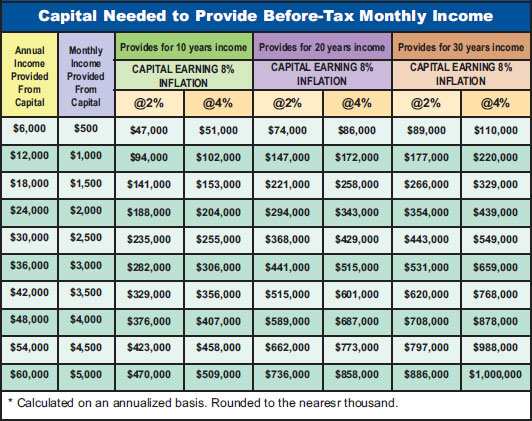

Examine the Future Retirement Income from potential savings in the following graph.

Source: Calculations by Adviceon

How do you set up a plan?

A good place to start is by contacting a tax professional familiar with retirement plans or an advisor and/or a financial institution that offers retirement plans.

Establishing your Employee Plan

You take the necessary steps to put your plan in place. Depending on the type of plan you choose, the administrative steps may include:

Operating your Employee Plan

You want to operate your retirement plan so that the assets in the plan continue to grow and the tax-benefits of the plan are preserved. The ongoing steps you need to take to operate your plan may vary depending on the type of plan you establish. Your basic steps will include:

All articles are a legal copyright of Adviceon®Media and are for educational purposes only. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This website is not deemed to be used as a solicitation in a jurisdiction where this representative is not registered. This content is not intended to provide specific personalized advice, including, without limitation, investment, insurance, financial, legal, accounting or tax advice; and any reference to facts and data provided are from various sources believed to be reliable, but we cannot guarantee they are complete or accurate; and it is intended primarily for Canadian residents only, and the information contained herein is subject to change without notice. References in this website to third party goods or services should not be regarded as an endorsement, offer or solicitation of these or any goods or services. Always consult an appropriate professional regarding your particular circumstances before making any financial decision. The information provided is general in nature and should not be relied upon as a substitute for advice in any specific situation. The publisher does not guarantee the accuracy and will not be held liable in any way for any error, or omission, or any financial decision.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investment funds, including segregated fund investments. Please read the fund summary information folder prospectus before investing. Mutual Funds and/or Segregated Funds may not be guaranteed, their market value changes daily and past performance is not indicative of future results. The publisher does not guarantee the accuracy and will not be held liable in any way for any error, or omission, or any financial decision. Talk to your advisor before making any financial decision. A description of the key features of the applicable individual variable annuity contract or segregated fund is contained in the Information Folder. Any amount that is allocated to a segregated fund is invested at the risk of the contract holder and may increase or decrease in value. Product features are subject to change.

Life Insurance policies vary according to contract terms. Please read any Life Insurance policy contract provided, or the segregated fund summary information folder prospectus before the time of purchase. Full details of coverage, including limitations and exclusions that apply, are set out in the policy of insurance. Commissions, trailing commissions, management fees and expenses may be associated with segregated fund investments which may not be guaranteed and their market value changes daily and past performance is not indicative of future results. A description of the key features of a life insurance policy, a segregated fund; and any applicable individual variable annuity contract is contained in information provided by the company from which it is purchased. Talk to your advisor before making any financial decision. For specific situations, advice should be obtained from the appropriate legal, accounting, tax or other professional advisors. The information provided is accurate to the best of our knowledge as of the date of publication and is general in nature, intended for educational purposes only, and should not be relied upon as a substitute for advice in any specific situation. For specific situations, advice should be obtained from the appropriate legal, accounting, tax or other professional advisors. Rules and their interpretation may change, affecting the accuracy of the information.