Steve Jobs, though he was a highly successful man, faced a terminal illness — a shrinking lifespan. Contemplating his remaining time, he became very focused:

“Remembering that I’ll be dead soon is the most important tool I’ve ever encountered to help me make the big choices in life. Because almost everything—all external expectations, all pride, all fear of embarrassment or failure—these things just fall away in the face of death, leaving only what is truly important.” Steve Jobs

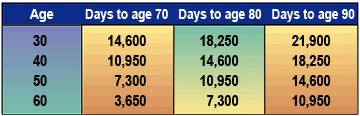

Think in terms of days When we look at our time in retirement regarding singular days (to get a different perspective), we begin to think about how much one can spend on a day’s outing, for example, just to get groceries. The following chart will give you an idea of how many days you will need to provide the basics of life: food, shelter, utilities, transportation, entertainment, etc.

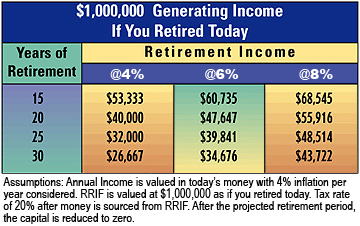

Consider your retirement income As you move into retirement, the following graph will give you an idea of your annual income and duration based on having one million dollars saved—here depicted in registered assets. It is best to look at the 4% column as we are currently in a low-interest period.

In good health or declining vigour, we ought to be just as aware of the sobering fact that we have a certain number of days in which to live in retirement — and do the most important things such as providing for yourself, a surviving spouse, visiting with ageing parents, children, grandchildren, and friends. You may also need to take holidays, enjoy day-trips, and engage in some culture or entertainment.

This all takes money. During this time, depending on your life expectancy, you will need to live from your savings. Don’t gamble your time away without getting an advisor to help you acquire your retirement capital to provide your future income.